fsa health care contribution

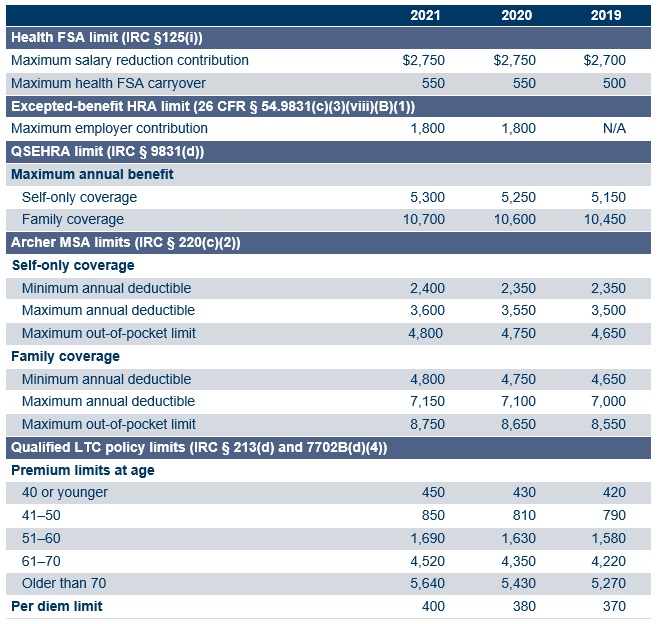

Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850. Health Care FSA.

Flexible Spending Accounts Hrc Total Solutions

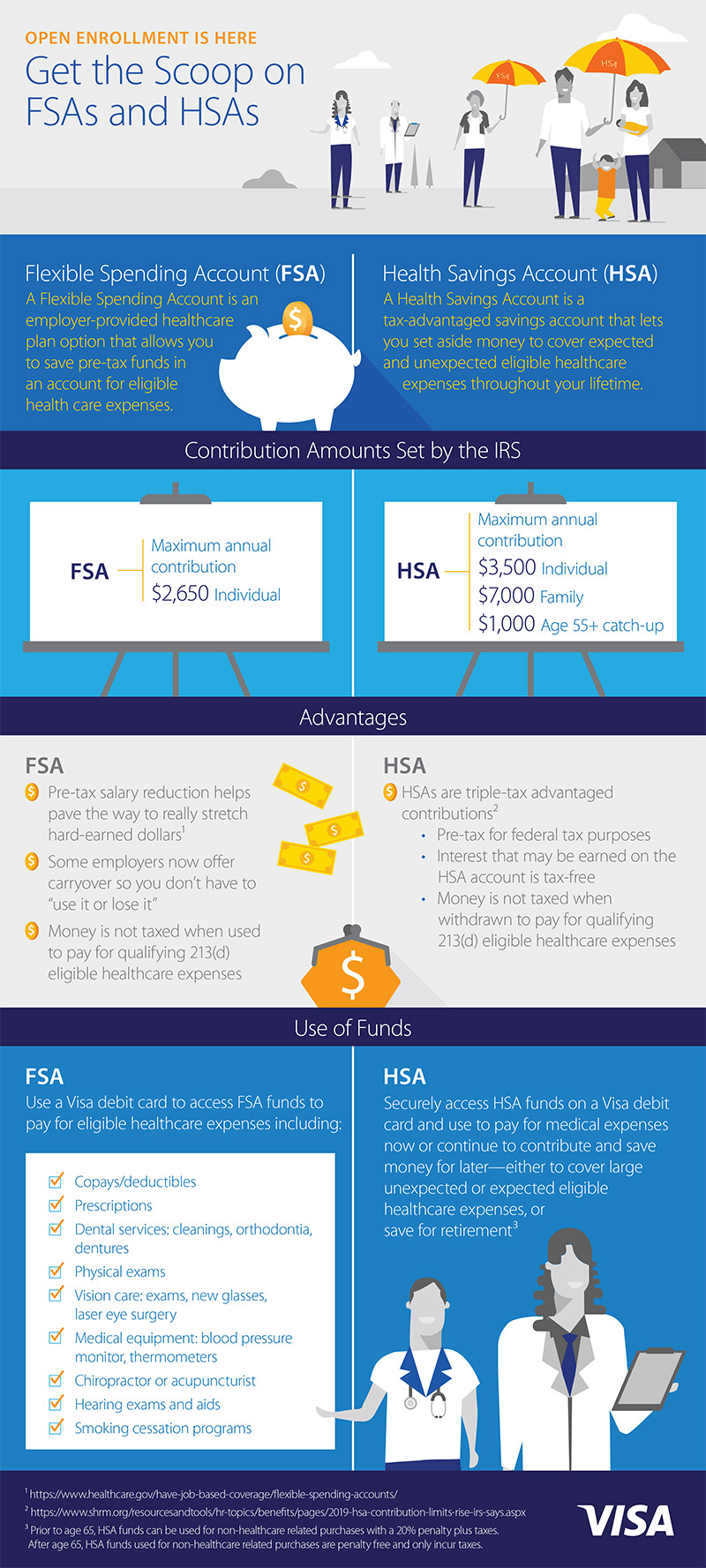

Contributing to an FSA reduces taxable wages since the account is funded with pretax dollars.

. Shop Now To Save More. FSAs only have one limit for individual and family health plan. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses.

If you are eligible to participate in the FSAFEDS program decide how much to contribute to your Health Care FSA account based on how much you plan to spend in the upcoming year on out. A health care FSA offered through a cafeteria plan. Ad Largest Selection Of FSA Eligible Health And Wellness Products Easy Buy Health Supplies.

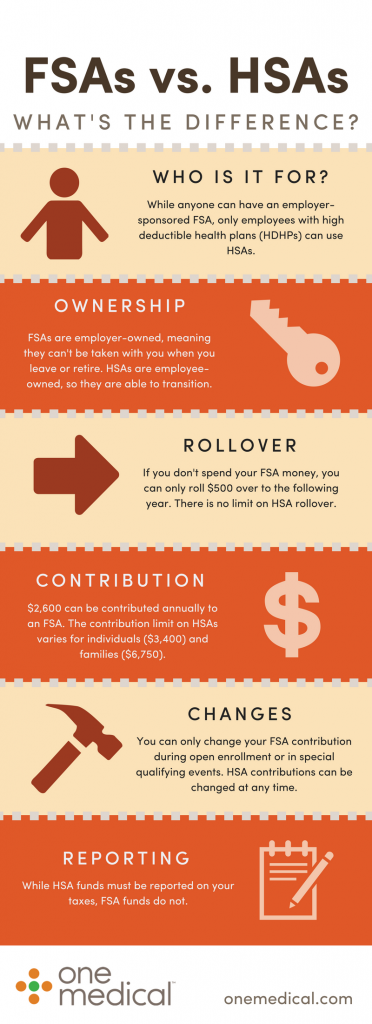

While the IRS 2021 pretax maximum for employee health FSA contributions is 2750 an employer may limit its employees to less than 2750. Under an employer-sponsored flexible spending account FSA plan employees can elect to contribute a designated amount of their annual salary to their personal health care. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

These limits are subject to change annually. Over 1 million doctors pharmacies and clinic locations. Limited Purpose FSA contribution limit - 2850.

Second your employers contributions wont count toward your annual FSA contribution limits. 2022 Health FSA Contribution Cap Rises to 2850. Your employer FSA or financial institution HSA decides their minimum contributions for example 100.

Get a free demo. 24-hour nurse help line and a team of medical experts. Dependent Care FSA contribution limit -5000.

Ad 247 virtual care. You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription. Keep in mind you may carry over up to 57000 remaining in your account from one.

The Health Care Spending Account HCSA is an employee benefit. You can contribute up to a maximum of 285000 to your Limited Expense Health Care FSA each year. Basic Healthcare FSA Rules.

A health care FSA reimburses employees for eligible medical expenses up to the amount contributed for the plan year. 23 2021 when the 2850 contribution was officially. Employees can elect up to the IRS limit and still receive the employer contribution in addition.

It helps state employees pay for health-related expenses with tax-free dollars. Health Care FSA contribution limit - 2850. This is an increase of 100 from the 2021 contribution limits.

If you have adopted a 570 rollover for the health care FSA in 2022 any amount that rolls over. Elevate your health benefits. Ad Custom benefits solutions for your business needs.

You also learn how much you could save on taxes. Easy implementation and comprehensive employee education available 247. This includes medical hospital laboratory.

For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. Walk-in care options nationwide. There are a few things to remember when it.

Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions. Since your 2000 FSA contribution is paid in pretax dollars it cannot be taken. The federal government decides HSA maximum amounts.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. For example if you earn 45000 per year. Healthcare Healthy Living Store.

Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through.

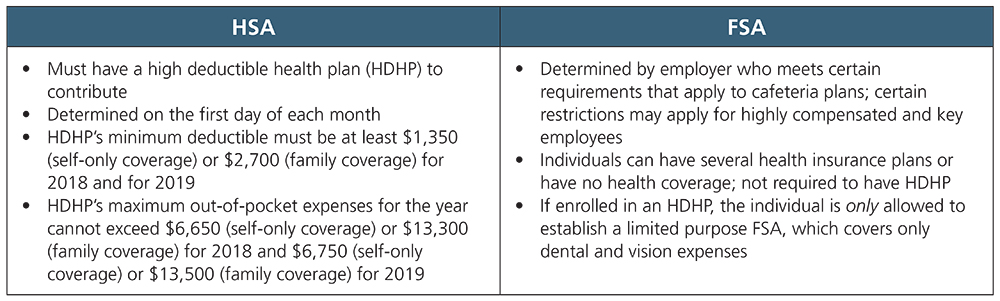

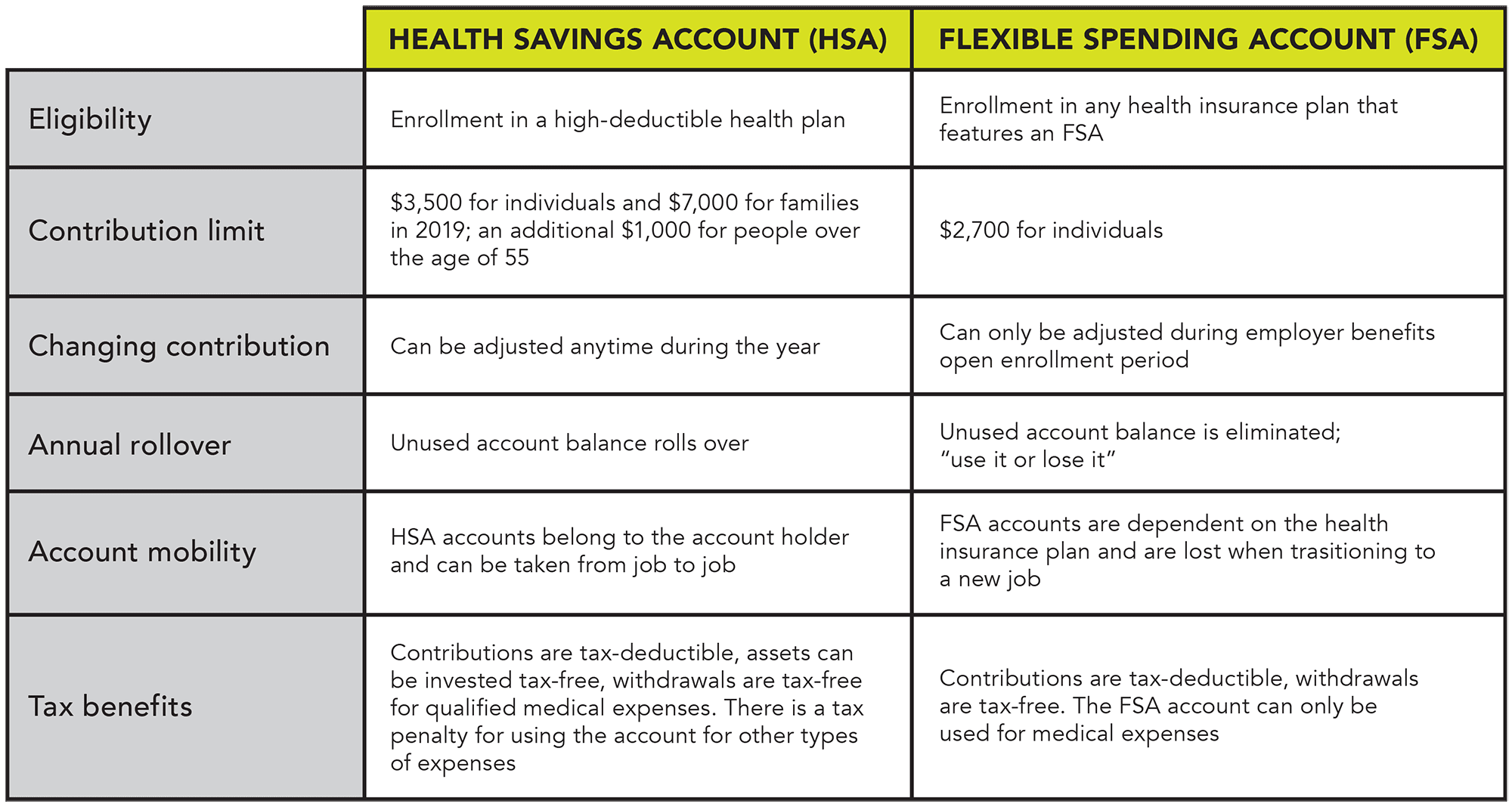

Hsa Vs Fsa Diagnosing The Differences Ascensus

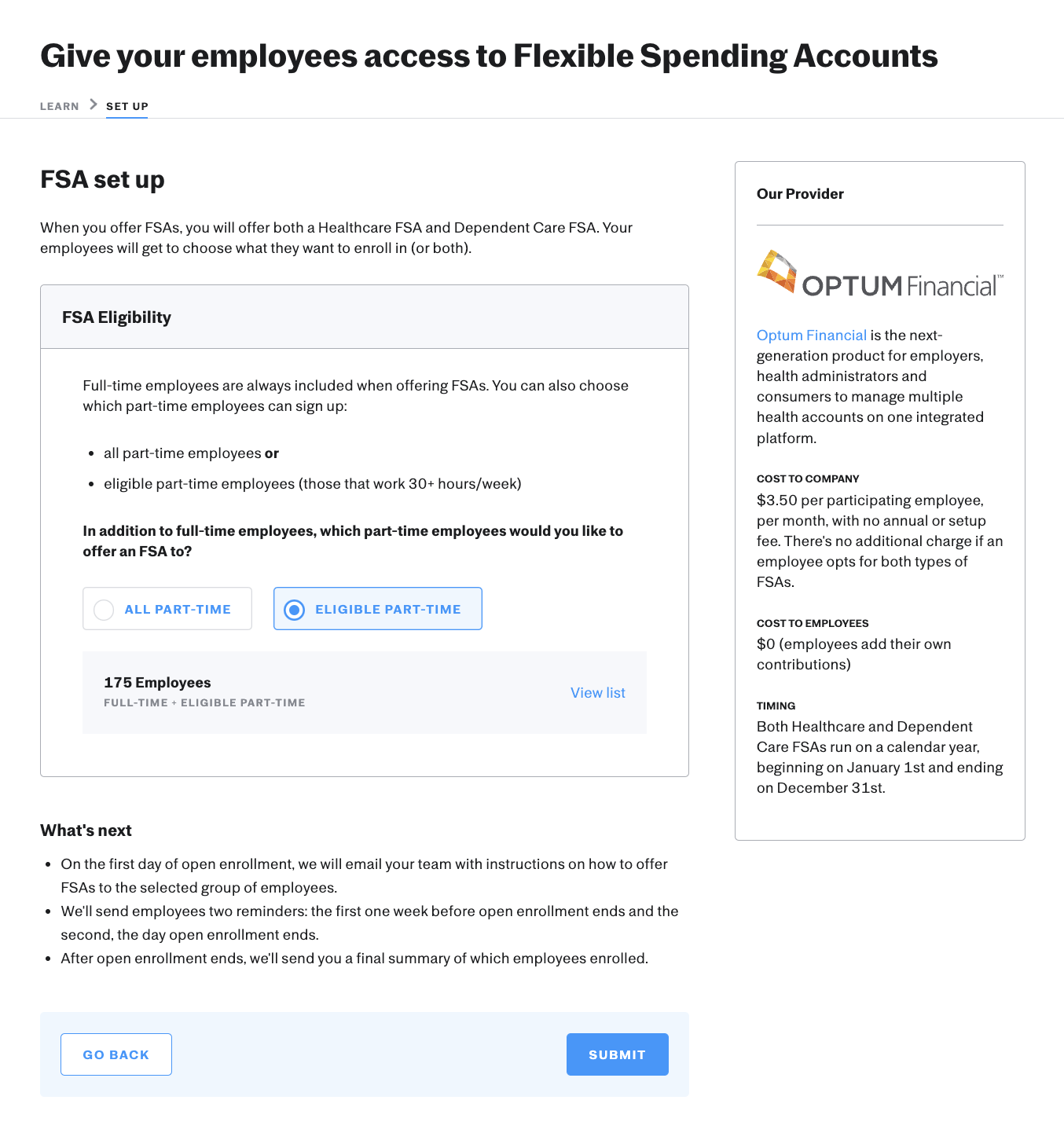

Flexible Spending Accounts Fsa Via Optum Financial Justworks Help Center

Health Care Flexible Spending Account Fsa Plan At A Flip Ebook Pages 1 3 Anyflip

Hsa Vs Fsa Comparison Chart Aeroflow Healthcare

Can Employers Add To Employee Health Fsa Contribution Core Documents

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Hsa Vs Fsa What Is The Difference Between Them Aetna

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Irs Allows Midyear Enrollment And Election Changes For Health Plans And Fsas

Flexible Spending Accounts Or Fsas What To Know Before You Opt In Contribute Or Spend

What Is A Flexible Spending Account Clydebank Media

Flexible Spending Account Fsa Faqs Expenses Limits Plans More

Why Do Consumers Leave So Much Fsa And Hsa Money On The Table Visa

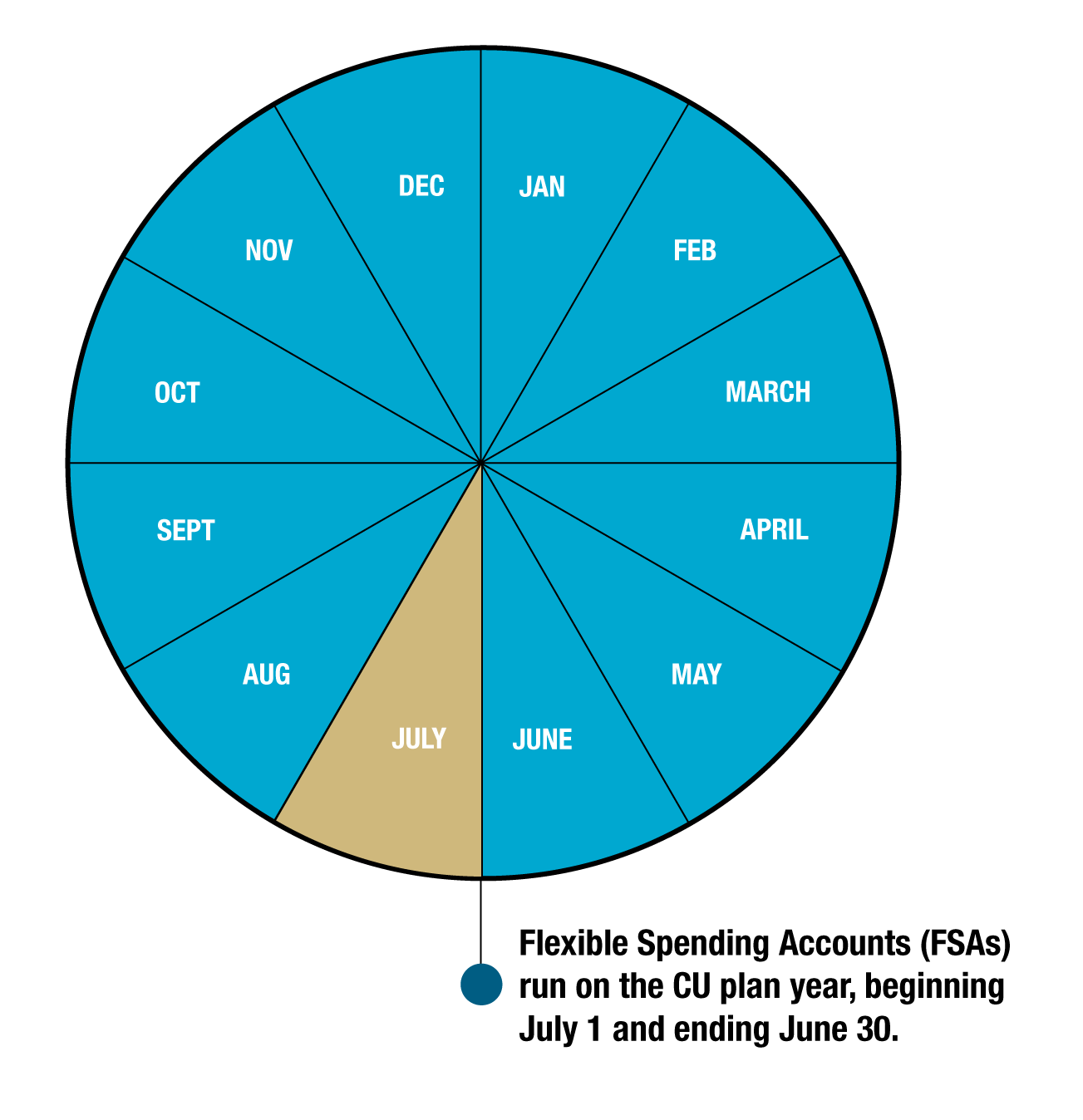

Health Care Fsa University Of Colorado

2021 Healthcare Fsa Contribution Limit Workest

What Do I Need To Know About Fsas And Hsas One Medical

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

2020 Fsa Contribution Cap Rises To 2 750

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer