ev tax credit 2022 california

Heres the list of electric cars made in North America which qualify now. Find Your 2022 Nissan Now.

Fedex Is Charging Up Its Electric Vehicle Fleet In 2022 Vehicles Fleet Electric Cars

Find Your 2022 Nissan Now.

. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. There are several California EV Tax Credit opportunities and incentives available. Discover electric vehicle tax credits in California and buy a new Toyota PHEV at our Victorville Toyota dealer.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. So when youre deciding on whether or not to. 7 months ago.

The EV rebate in California offers a huge incentive to drive electric vehicles - but its not the only one. Electric Vehicle Charging Station Tax Credit Author. For instance low-income homeowners can get up to 100 of electrification projects covered.

What Is the New Federal EV Tax Credit for 2022. In some cases the state. An income test must come.

Essentially any PHEV that meets the minimum requirements as outlined above qualifies for at. Updated information for consumers as of August 16 2022 New Final Assembly Requirement. It also includes tens of billions of dollars in new loan tax credit and grant.

If you are interested in claiming the tax credit available under section 30D EV. California is lowering its MSRP limit and income cap for EV subsidies which offers 2000 USD for EVs and 1500 for plugin hybrids according to Green. Ad Build Price Locate A Dealer In Your Area.

The maximum amount of the extended EV tax credit is 7500 credit for new vehicles. By Nadia Lopez August 2 2022 August 2 2022. Quentin Nelms who lives in Tulare qualified for a state subsidy but the electric cars cost rose too fast.

Up to 1000 state tax credit Local and Utility Incentives. The credit amount will vary based on the capacity of the. Ad Build Price Locate A Dealer In Your Area.

California has been a forerunner in encouraging the adoption of electric vehicles. Learn more about EV tax rebates in CA. The Clean Vehicle Rebate Project CVRP promotes clean vehicle adoption by offering rebates of up to 4500 for the purchase or lease of new eligible zero-emission vehicles including.

Electric Vehicle Charging Station Tax Credit Keywords. Electric Vehicles Solar and Energy Storage. The value of the EV tax credit youre eligible for depends on the cars battery size.

In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. As with the EV tax credit 2022 the CVRP operates from a graduated scale giving between 1000 and 7000 in credits against tax obligations. Electric Vehicle Charging Station Tax Credit.

Can you receive an EV charger tax credit when you install an electric vehicle charger. A new 4000 or 30 of purchase price whichever is less credit was added for used. For example if you purchase an EV eligible for 7500 but you owe only 4000 in taxes you will receive a 4000.

The proposed electric vehicle tax credits for 2022 are refundable meaning you could potentially get money back from the government for simply buying an EV. Discover the instant acceleration impressive range nimble handling of Nissan EVs. Theres a 14000 cap on the dollar amount of rebates offered under the program.

The EV tax credit has changed and many cars are no longer eligible. The location of final assembly needs to be in North Americathats the US Canada or Mexico in this caseto claim it on vehicles purchased on or after August 16 2022. 1 day agoThe bill restructures the existing 7500 new-EV tax credit and creates a 4000 rebate for used EVs.

16th 2022 611 pm PT 0. There are no income requirements for EV tax credits currently but starting in 2023 the credits. Did you know you might also qualify a 7500 federal tax credit for new all-electric.

Discover the instant acceleration impressive range nimble handling of Nissan EVs. Note that the federal EV tax credit amount is affected by your tax liability. Heres how to find out and what the federal and state incentives for installing.

If youre wealthy and you want to use the EV tax credit 2022 is the time to buy. Reduced Vehicle License Tax and carpool lane access.

Contact Cal Spray Foam Installers Nearby Bakersfield Californialocal Spray Foam And Insulation Installers In Bak Spray Foam Bakersfield California Foam Roofing

Program Info California Clean Fuel Reward

Electric Car Tax Credits In California Ev Incentives In Ca

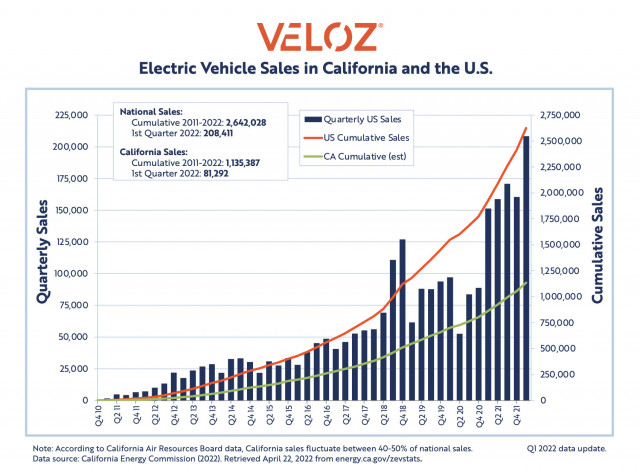

Veloz California Ev Market Continues Strong Growth Q1 Strongest Quarter To Date 16 32 Market Share Green Car Congress

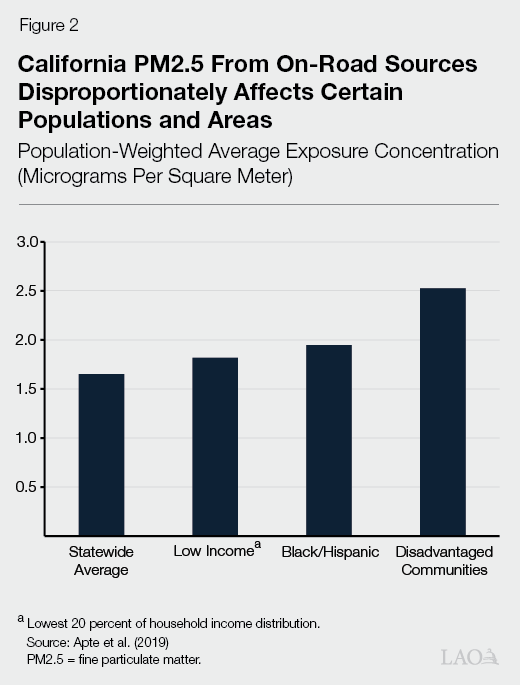

The 2022 23 Budget Zero Emission Vehicle Package

Us Plug In Vehicle Sales Hit A Record High In Q1 Led By Tesla And California

The Electric Vehicle Rebate In California And Other Incentives Coltura Moving Beyond Gasoline

Form W 4 Employee S Withholding Certificate 2021 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Internal Revenue Service

Amid Heat Wave California Asks Electric Vehicle Owners To Limit Charging The New York Times

Climate Bill Would Create Roadblock For Full Ev Tax Credit E E News

Uber Electric Vehicle Incentives

Southern California Edison Incentives

The Electric Vehicle Rebate In California And Other Incentives Coltura Moving Beyond Gasoline

7 California Solar Incentives You Need To Know In 2022 And Beyond Aurora Solar

2021 Ford Mustang Mach E Gt Suv Model Details Specs Suv Models Ford Mustang Bmw Cars

.jpg)